Why Financial Wellness Programs Matter in Nigeria

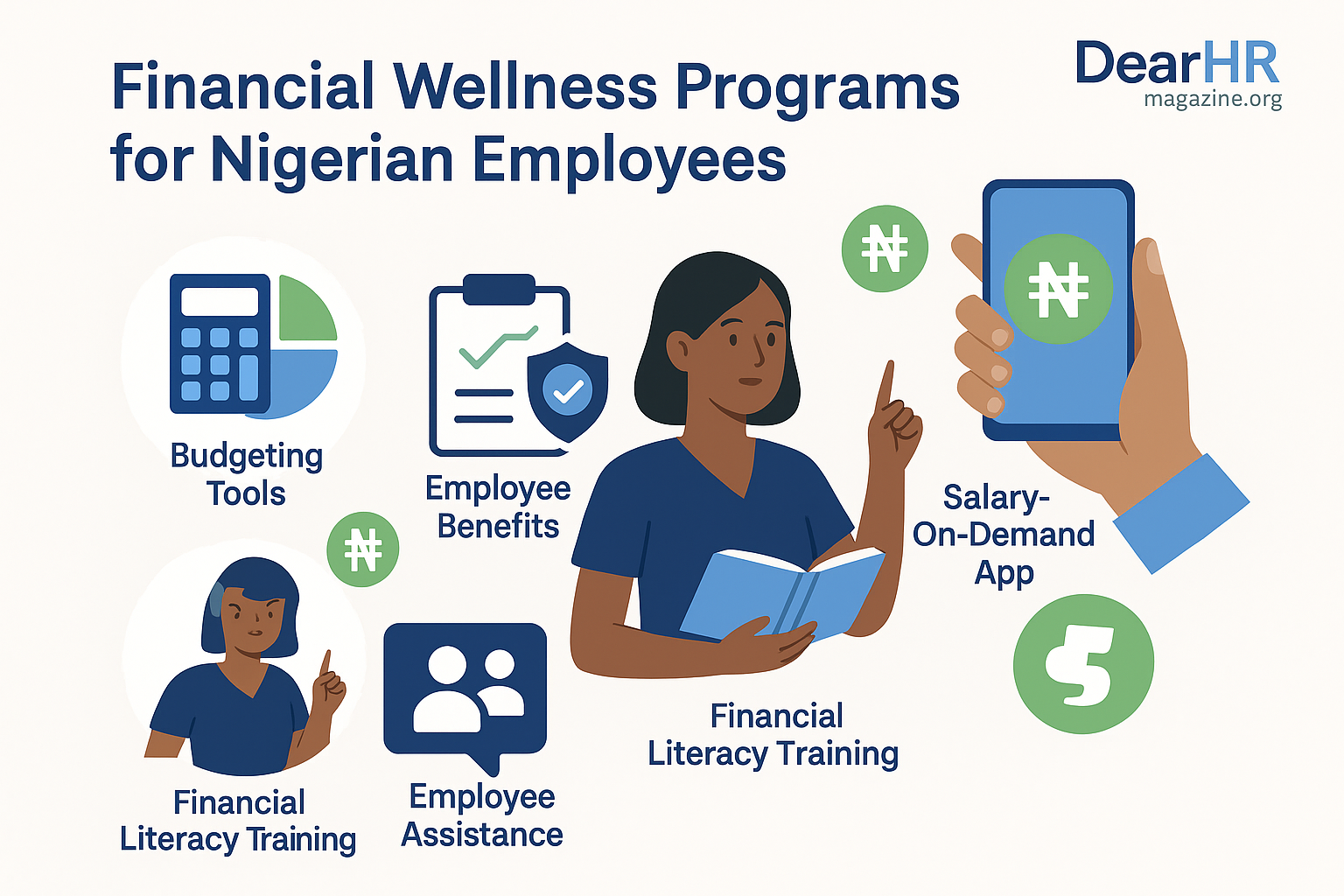

Financial fitness at work is crucial for Nigerian employees, as money worries can significantly impact productivity. To address this, financial wellness programs Nigeria are employer-led initiatives designed to equip staff with budgeting tools, debt-management education, and on-demand support. The most recent PwC financial wellness survey revealed that financial stress negatively impacts employee performance each month. These money worries don’t just affect how employees feel—they often lead to increased absences and lower overall motivation at work.

This post explores how well-structured employee benefits can help turn financial stress into stability. Backed by insights developed for DearHRmagazine’s professional HR audience and Nigerian workforce, we’ll walk you through practical strategies to strengthen employee financial wellness Nigeria, reduce turnover, and build a more productive, resilient workforce.

Understanding Employee Financial Wellness Nigeria

Economic Pressures on Workers

Over the past year, Nigeria’s inflation rate climbed to roughly 30% year-on-year in May 2025, while the cost-of-living index for essentials—food, housing and transport—jumped by over 15% (NBS).

As a result, many employees find that their take-home pay can no longer keep up with rising living costs, putting pressure on household budgets and increasing interest in financial wellness programs Nigeria. In addition, fluctuations in the currency and recent changes to fuel subsidies have added to the uncertainty, leading workers to actively look for practical support—like budgeting sessions and salary-on-demand tools—to help manage their finances more effectively.

Impact on Productivity and Retention

Financial stress isn’t just a personal burden: it chips away at team performance and loyalty. A 2023 PwC survey revealed that staff under acute money worries are 25% more likely to quit within six months. In firms lacking robust employee benefits, voluntary turnover can surge above 20%. By prioritising employee financial wellness Nigeria—through EAP integration, financial literacy programs Nigeria and innovative digital solutions like financial wellness apps—organisations can curb attrition, reduce absenteeism and unlock a more engaged, resilient workforce.

Key Elements Every Employer Should Include

To build impactful financial wellness programs in Nigeria, organizations must combine education, access and support into a cohesive employee benefits strategy. By doing so, companies can proactively address money worries, reinforce trust and position themselves as employers of choice in a competitive talent market.

Financial Education & Literacy Training

Firstly, financial literacy programs lay the groundwork for informed decision-making. Workshops on budgeting fundamentals, debt-management webinars and interactive e-learning modules equip staff with the knowledge and confidence to navigate expenses. Moreover, partnering with certified financial coaches—either in-house or via specialist providers—ensures that employees receive expert guidance tailored to common local challenges, such as rising utility costs and subsidy fluctuations.

Earned-Wage Access & Salary-On-Demand

Next, offering employee financial assistance through earned-wage access platforms and salary-on-demand services bridges the gap between paydays. These tools—often delivered via seamless financial wellness apps Nigeria—allow workers to access a portion of earned wages instantly, reducing reliance on high-interest loans. Additionally, users benefit from real-time budgeting alerts and automated savings features, reinforcing healthy money habits and enhancing overall employee financial wellness in Nigeria.

Employee Assistance Programmes (EAPs) Integration

Finally, integrating an EAP with your financial wellness program amplifies impact. While EAPs traditionally cover counseling and mental health support, extending their scope to include one-on-one financial coaching or referrals to licensed advisors creates a holistic well-being framework. Consequently, staff see these programs as essential lifelines, not just added benefits, driving higher uptake rates, lower turnover, and measurable gains in engagement.

Real-World Examples Demonstrating ROI

Tech Startup in Lagos

In 2024, a top Nigerian commercial bank launched a tailored employee support initiative combining financial wellness programs Nigeria, salary-on-demand access, and one-on-one coaching through an expanded Employee Assistance Programme (EAP). The goal was to ease financial pressure, improve workplace focus, and boost overall engagement. The program design featured interactive budgeting workshops, personalised financial coaching, and a mobile-based financial wellness app Nigeria integrated with payroll.

Within three months of launch, 75% of employees enrolled, and usage data showed high engagement with the salary access tool and monthly coaching sessions. Managers reported a 12% increase in team productivity, and 80% of staff said their ability to manage money had improved. Financial stress-related complaints during HR check-ins dropped noticeably, while the EAP recorded increased uptake, particularly for budget coaching and short-term planning support.

This case proves that strategic employee benefits focused on employee financial wellness don’t just boost morale—they deliver measurable business outcomes. For Nigerian organisations navigating inflation and high staff turnover, financial wellness is no longer optional. It’s a proven driver of performance, retention, and trust.

Top Financial Wellness Apps and Solutions in Nigeria

Choosing the right tools is crucial for organisations looking to implement successful financial wellness programs in Nigeria. From mobile budgeting apps to fully integrated HR-tech platforms, the right solution can simplify access, improve engagement, and boost employee financial wellness Nigeria.

Budgeting & Money-Management Apps

Several Nigerian fintech companies are making financial wellness more accessible through intuitive apps tailored to local needs. Tools like SmartSave, Kuda, and Rise offer goal-based savings, real-time spending alerts, and micro-investment options—all designed to promote healthy financial habits. These financial wellness apps are particularly effective for younger employees, enabling self-paced learning and instant tracking of daily expenses. When integrated with in-house initiatives like financial literacy programs, they significantly increase uptake and long-term behaviour change.

Comprehensive HR-Tech Platforms

Beyond budgeting apps, some platforms offer bundled employee benefits that combine financial support, employee health insurance, and access to on-demand salary tools. Providers like SeamlessHR and MyBenefitHub allow HR teams to manage payroll, EAP services, and financial education from one central dashboard. This all-in-one approach streamlines operations and enhances employee financial wellness Nigeria, making it easier to align financial support with broader wellbeing strategies.

How to Launch a Financial Wellness Program in Your Company

Implementing effective financial wellness programs Nigeria requires more than good intentions—it demands strategy, structure, and stakeholder buy-in. HR leaders must align initiatives with company culture, available resources, and employee needs to ensure long-term impact.

Assess Needs & Set Objectives

Begin by surveying your workforce to understand their financial stress points. Are employees struggling with debt, saving for emergencies, or managing monthly expenses? Use this data to define clear goals—such as improving savings rates or reducing financial stress complaints. Align these objectives with broader employee benefits and retention strategies.

Select Partners & Tools

Next, identify the right partners to deliver your solution. This could include local fintechs offering financial wellness apps in Nigeria, HR-tech platforms, or certified financial coaches. Choose tools that integrate easily with payroll, support EAP functionality, and offer modular features like budgeting, salary advance, and financial literacy programs.

Roll-Out, Communication & Ongoing Evaluation

Finally, launch your program with strong internal communication. Use email, staff meetings, and onboarding sessions to explain benefits and how to access them. Continuously track participation, usage trends, and staff feedback to measure ROI and refine your approach. When well-executed, employee financial wellness programs strengthen both employee trust and business outcomes.

Key Metrics and Feedback Loops

To ensure your financial wellness programs deliver real value, track both engagement and business outcomes. Start by measuring participation rates and program uptake—for example, what percentage of staff attend financial literacy workshops or download your chosen budgeting tool. Complement this with employee satisfaction surveys to gauge perceived benefits and identify areas for improvement.

Next, link these insights to organisational KPIs: monitor changes in employee retention, reductions in absenteeism, and boosts in productivity metrics such as output per full-time equivalent. By establishing regular feedback loops—combining quantitative data with qualitative comments—you can refine your employee benefits mix, reinforce employee financial wellness Nigeria, and demonstrate clear ROI to stakeholders.

Empower Your Workforce Today

As inflation and financial stress continue to challenge the Nigerian workforce, investing in financial wellness programs Nigeria is no longer optional—it is strategic. These initiatives strengthen employee benefits, improve retention, and support long-term business growth. By prioritising employee financial wellness through tools like EAPs, budgeting apps, and education, your organisation builds trust and resilience.

Now is the time to take action. Begin assessing your team’s needs and explore local solutions tailored to Nigeria’s unique economic realities. Empower your workforce with the tools they need to thrive—financially, professionally, and personally.

Read also from us:

- Workplace Mental Health Nigeria

- Employee Engagement Strategies for Nigeria SMEs

- Employee Upskilling Through Learning and Development in Nigeria

Frequently Asked Questions (FAQs)

1. What are financial wellness programs Nigeria companies can adopt?

These include budgeting tools, financial coaching, salary advances, and education programs that help employees manage money better.

2. How do financial wellness programs improve employee retention in Nigeria?

By reducing money-related stress and offering real support, employees are more likely to stay loyal and focused.

3. Can small businesses offer financial wellness programs?

Yes! Even low-cost solutions like group workshops, EAP referrals, and mobile apps can significantly boost employee financial wellness Nigeria.

4. What tools or apps are best for Nigerian employees?

Platforms like SmartSave, Kuda, and local HR tech providers offer customisable solutions for savings, salary access, and expense tracking.